EV Financing: A massive opportunity for new-age financiers

Aman Raj, Mandeep Kaur Julka

June 10, 2025

Everyone’s talking about EVs the sleek scooters, the zippy autos, the climate promise. But beneath the surface, there’s one piece of the puzzle quietly powering this transition: financing.

If you’re looking at India’s EV shift, you might want to stop looking just at the batteries and OEMs. Because without financing, there’s no adoption. And right now, EV financing is shaping up to be one of the most overlooked yet exciting investment opportunities in India’s mobility space.

EV Demand Is Real and It’s Only Just Getting Started:

EVs in India aren’t a trend, they’re a full-blown movement. Especially in the two- and three-wheeler categories.

India is the world’s largest two-wheeler market. In FY24 alone, it sold nearly 1.85 crore 2Ws. And even within that, there’s headroom to grow. Per capita 2W ownership is still relatively low (around 116–118 per 1,000 people), so the tailwinds are strong.

Meanwhile, the 3W space is seeing explosive EV adoption. Over half of all 3W sales in FY24 were electric.

Why the surge?

- Lower cost of ownership: For someone driving 8,000 km a year, an e2W is nearly 37% cheaper to run than its petrol counterpart. Throw in subsidies, and the savings shoot up to 55%.

- Faster replacement cycles: The old 10–12 year hold period for 2Ws has now dropped to 7–8 years. People are upgrading faster.

- Urbanization and rising incomes: This isn’t just a metro story. Tier II and III cities are driving demand, and that’s where EVs often make the most financial sense.

- Better tech and vehicle options: More OEMs are launching EV models with better design, performance, and price points.

Why EV Financing Is Not Just Regular Vehicle Financing?

On paper, lending for EVs looks a lot like lending for any vehicle. But it is not – it is lending to an electric vehicle, which is a different asset. And this difference makes this sunrise sector a promising opportunity for new players.

First, traditional lending processes, including underwriting, collections, etc. are built around ICE vehicles. Incumbent lenders have been underwriting petrol bikes and diesel autos for decades, and these processes require upgrading, especially from the technology angle, hampering their efficiency, TATs, etc. metrics. For eg, these processes are often slow, offline, and not equipped to deal with the advanced tech and new systems of the EV ecosystem.

In the contemporary times of 10min deliveries, TATs of 2-7 days are untenable. Therefore, the new-age lenders, especially for EVs, need faster, more tech-enabled models.

Further, the EV dealership networks are new. As traditional auto manufacturers such as TVS, Bajaj, etc. were relatively late to enter the EV cycle, new age entrants such as Aether, Piaggio, Montra, etc. have established their own respective EV dealerships and networks around them.

While the customer profiles remain similar to ICE (especially for 3W), the vehicles themselves could seem to vary widely as there are many OEMs operating in the space. However, on digging deeper, one realizes that differences are mainly due to the nature of the battery and its OEM – a Li Ion (contemporary) vs a Lead Acid (earlier models). Therefore, the actual underwriting of the vehicle needs to consider the battery, and its ecosystem such as number, warranties, performance, maintenance and buyback agreements with OEMs. etc. Underwriting all this takes a different kind of risk playbook, including factors such as battery degradation, resale value, and even usage patterns.

Regional NBFCs, which dominate 2W and 3W financing in many Tier II and III cities, face additional challenges. Many are family-run, operate manually, and have limited tech and capital to compete in a digital-first EV financing game.

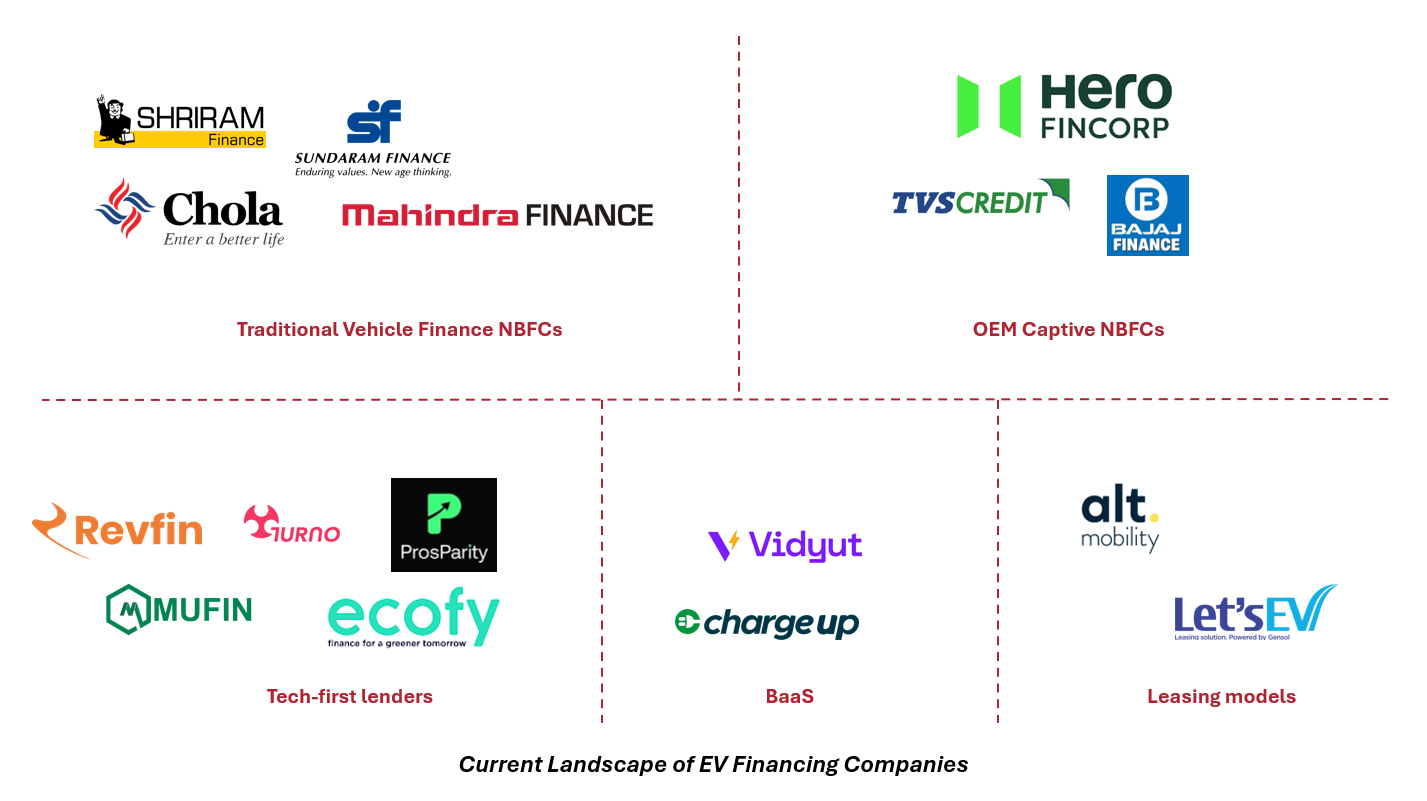

All this opens the door for new players who can build specifically for EVs with tech-first processes, leaner cost structures, and smarter underwriting.

Why This Is a Market Worth Betting On?

By our estimates, the EV financing opportunity (disbursements) in 2W and 3W alone is projected to be ~INR 52,000 crore per year by 2030.

Even today, 85–90% of 3Ws and 50–70% of 2Ws are bought using loans. That preference doesn’t go away in EVs. If anything, it becomes even more critical as upfront EV prices are still slightly higher than ICE.

The market is also naturally leaning toward smaller towns and cities, where demand is credit-driven. And in these markets, dealers and customers care less about financier’s brand name and more about how quickly and smoothly one can disburse a loan. Therefore, if a lender can build a trusted dealer network, it can drive scale and profitability, both.

What Could Go Wrong? And why we think it’s manageable.

Sure, this isn’t a risk-free game. But most of the risks are early-stage and are being solved for.- Resale of EVs is still tricky. There isn’t yet a mature secondary market. But some lenders are solving this by getting buyback commitments from OEMs or working with dealers for repossession and resale.

- EV performance can vary by OEM and model. A strong credit engine has to go beyond the borrower and assess the OEM, battery type, and dealer too.

- Government subsidies are tapering. True. But the market is increasingly subsidy-independent, and the TCO still works in favour of EVs.