The Untapped Potential: Why India's Physiotherapy Revolution is Just Beginning

A silent epidemic affects nearly 35-40 crore Indians today—chronic musculoskeletal pain that limits mobility, reduces productivity, and diminishes quality of life. Yet unlike many healthcare challenges, this one remains largely unsolved, creating a remarkable opportunity for founders with vision and determination.

The Perfect Storm

First, India faces a critical shortage of qualified physiotherapists—just 0.6 per 10,000 people compared to the WHO’s recommended minimum of 1.0. For USA the numbers is approximately 7.2 per 10,000 people. This gap won’t be closed through traditional means alone, creating space for technology-enabled solutions that extend the reach of existing professionals.The Spaces Where opportunities exist

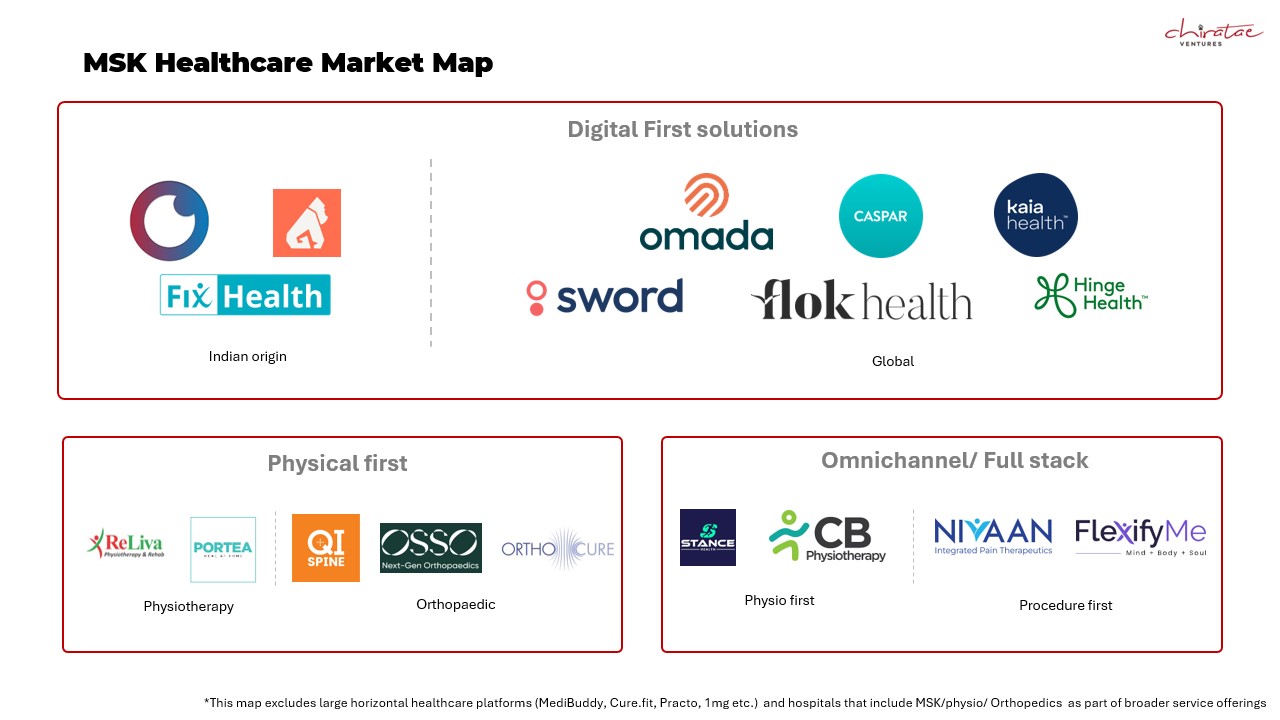

As we look at the landscape, six distinct opportunity spaces emerge for founders ready to build the next generation of MSK care solutions in India.1. AI-Powered Analysis Platforms

The traditional approach to physiotherapy assessment requires in-person sessions with specialists who are already in critically short supply across India. Millions of patients struggle with proper form during home exercises or tracking the improvement in movement over the course of a treatment. This reduces effectiveness and potentially causing new injuries when practicing without guidance.We think the opportunity lies in building proprietary algorithms and creating interfaces that work for individuals or establishments making access to reliable tracking easy and accurate.

2. Global Telerehabilitation Services: Built in India, for the World

While India’s domestic market presents enormous opportunities, an equally compelling opportunity exists in leveraging India’s talent, cost advantages, and digital infrastructure to serve the global MSK market. The worldwide demand for physiotherapy far exceeds supply, with waiting times for specialist care stretching to weeks or months in many developed countries, while costs can be prohibitive for many patients.3. Geriatric-Focused Digital Physiotherapy

India’s elderly population is growing rapidly (decadal growth rate of 41%) and faces unique MSK challenges that general solutions don’t adequately address. Mobility limitations make clinic visits difficult, while historical technology barriers can make digital solutions inaccessible. Yet this demographic has both the highest need and the greatest potential lifetime value for physiotherapy services.India’s elderly segment is now the largest share of market and ageing population makes it a fast growing one. We believe the opportunity is to build specialized interfaces that overcome technology barriers for older adults, create content specifically addressing age-related MSK conditions, and build family-inclusive models that enable loved ones to participate in the care journey. The opportunity extends beyond direct-to-consumer approaches to include care facilities, retirement communities, and healthcare systems seeking better solutions for their aging patients.

4. Hybrid Care Model Expansion

The physiotherapy market has historically been split between pure digital and pure physical models, but evidence increasingly shows that neither approach alone delivers optimal results for patients. While digital solutions offer convenience and accessibility, many patients still need personal touchpoints for initial assessment, complex issues, and accountability.5. Workplace MSK Prevention Platforms

India’s growing corporate workforce is experiencing an epidemic of MSK issues driven by increasingly sedentary work environments. Daily steps have plummeted from an average of 5,000 to just 1,800 for many office workers, while stress-related tension compounds the physical toll of desk work. These issues reduce productivity, increase absenteeism, and create substantial healthcare costs for both individuals and employers.Corporate awareness about wellness and productivity and increasing insurance penetration of formally employed people is at an all-time high, creating an interesting opportunity for B2B solutions focused on prevention rather than treatment.

6. Rural Telerehabilitation Networks

Perhaps no opportunity in this space has greater potential impact than extending quality MSK care to India’s vastly underserved rural population. Despite high prevalence of MSK conditions exacerbated by physical labor, rural Indians have almost no access to qualified physiotherapists. Yet these communities represent more than half the country’s population and suffer disproportionately from preventable and treatable MSK issues.What makes this opportunity uniquely timely is the digital foundation that now exists in rural India. Over half of India’s 820 million internet users are in rural areas, creating unprecedented connectivity to previously unreachable populations. Government initiatives like the National Digital Health Mission are accelerating digital health adoption in rural regions, building infrastructure that innovative companies can leverage.